One thing that FreshBooks has that QBO lacks is excellent customer support. It may also be a more affordable option provided you don’t have many users, as FreshBooks charges an additional fee per user. The more expensive plans include cpa bookkeeping services additional users, in-depth reporting, and advanced features. QuickBooks Online is cloud-based accounting software that boasts strong reporting, customizable invoices, inventory management, multiple currencies, and 750+ integrations. FreshBooks’ pricing starts at $17 per month, so it costs a little less than QuickBooks’ $20-per-month plan. FreshBooks stands out for a great set of features, but it does not offer the payroll processing or advanced tools that QuickBooks has.

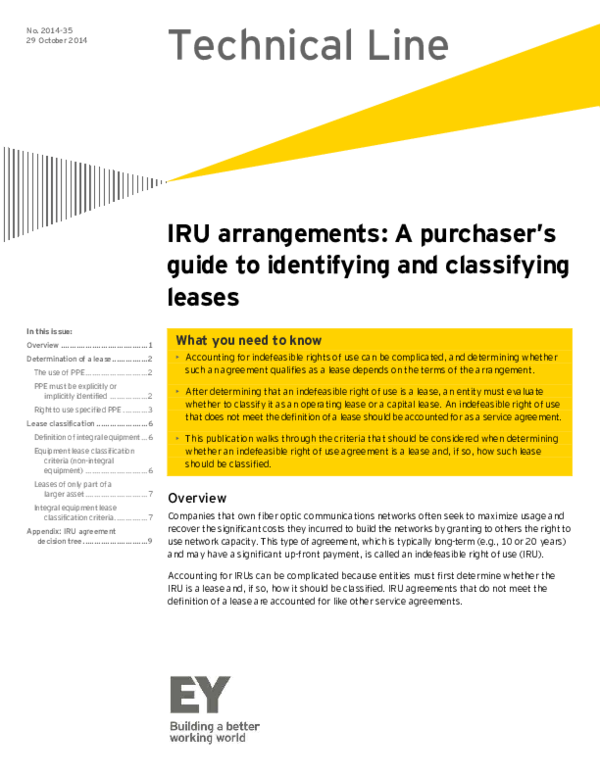

QuickBooks Versions Comparison

QuickBooks Enterprise, then, will be the only remaining desktop solution. QuickBooks Online is a cloud-based accounting platform while QuickBooks is a desktop program that provides additional inventory management features. Terms, conditions, pricing, special features, and service and support options subject to change without notice. Requires a separate QuickBooks Payments account which is subject to eligibility criteria, credit and application approval.

QuickBooks Desktop Pro is best for small to medium-sized businesses with three users or fewer looking for strong accounting or locally-installed software. Unfortunately, QuickBooks no longer offers this option for purchase online. To purchase QuickBooks Desktop Pro, you will need to contact QuickBooks Sales by phone. QuickBooks Solopreneur (formerly QuickBooks Self-Employed) isn’t quite accounting software. QuickBooks Self-Employed is tax software created to help freelancers manage their finances.

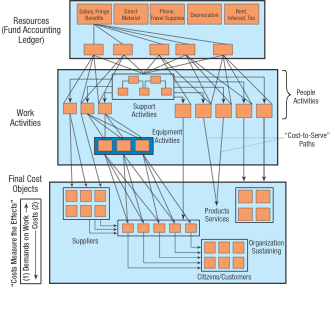

By providing feedback on how we can improve, you can attention required! cloudflare earn gift cards and get early access to new features. Here’s a complete breakdown of what’s included with each QuickBooks Online pricing plan. Go beyond bill pay and track bill status, create recurring payments, and pay multiple vendors at once. Monitor product levels, cost of goods, and receive notifications when inventory is low so you never run out.

- Due in part to these reasons, QuickBooks is our pick for the best hospitality accounting software.

- Intuit is constantly offering discounts for QuickBooks Online, so be sure to check for any current promotions.

- When it seems like there is a business software application for everything, it pays to be choosy.

- If you want to give QuickBooks a try before buying, you can sign up for a free 30-day trial or use the company’s interactive test drive that’s set up with a sample company.

- This software is best suited for freelancers, allowing them to track income and expenses, track mileage, estimate quarterly taxes, and run basic reports.

Find a plan that fits you

If you’re a small business looking for accounting software, you might want the Simple Start Plan, which allows you to create and manage invoices, estimates, bills, and sales taxes. Merchant Maverick’s ratings are editorial in nature, and are not aggregated from user reviews. Each staff reviewer at Merchant Maverick is a subject matter expert with experience researching, testing, and evaluating small business software and services. The rating of this company or service is based on the author’s expert opinion and analysis of the product, and assessed and seconded by another subject matter expert on staff before publication.

If your small business needs a payroll solution, be sure to add this cost to the regular QuickBooks Online monthly fee. Read our complete QuickBooks Online Payroll review for the details, and be sure to how do i write a business plan for a nonprofit organization visit the QBO website to see if Intuit is running a QuickBooks payroll discount before buying. QuickBooks Solopreneur is a “lite” version of the online product that’s ideal for people who earn income from a variety of sources and helps to separate personal and business finances. Customer support includes 24/7 help from a virtual assistant (chat bot) as well as live phone and chat support during daytime hours, Monday through Saturday. While cost is an important consideration, it shouldn’t be the only deciding factor when evaluating your accounting software options.

QuickBooks Online Integrations

If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees. QuickBooks Online and QuickBooks Solopreneur are the best for businesses wanting cloud-based software with mobile apps. QuickBooks Solopreneur is specifically for freelancers, while QuickBooks Online is a good fit for nearly any size business. QuickBooks Desktop Pro is the software that put QuickBooks on the map. In terms of accounting, QuickBooks Pro is one of the most developed solutions available, boasting a chart of accounts, journal entries, bank reconciliation, 130+ reports, and more.

We spend hours researching and evaluating each accounting software system we review at Merchant Maverick, placing special emphasis on key characteristics to generate our ratings. QuickBooks Online comes with a wide breadth of features and has the complex accounting capabilities that small business owners need. Other support options include live chat, a knowledgebase, community forum, helpful tutorials, and a company blog. Additionally, there are numerous time-saving automations, such as recurring invoices and auto-scheduling. QuickBooks users can also easily apply for funding through the built-in lending platform QuickBooks Capital.

In terms of features, integrations, reporting, and ease of use, QuickBooks holds its own. For just $50, QuickBooks Live Bookkeeping will set you up with an expert for one session. This plan is designed for freelancers who file a Schedule C IRS form to report their income as sole proprietor. QuickBooks Online plans are incredibly scalable, so you can start small and upgrade to a larger plan in the future. The answers to these questions should help you determine which plan is best for your business. QuickBooks Online is almost always offering a discount on its website, so be sure to check for any promotions before buying.

QuickBooks has also stopped allowing users to file their sales taxes online through the service. You’ll need to file business taxes manually and update your QuickBooks account with the information afterward. It’s one of the most popular accounting software options in the world, and our researchers ranked it the highest overall, meaning that it’s the top pick for the average business, small or large.